Bitcoin, Gold, and a Short History of Bubbles

Dave Nickle, HNW Financial

Bitcoin, Gold, and a Short History of Bubbles

Dave Nickle, HNW Financial

Since Donald Trump became President Elect, the price of Bitcoin has been surging higher. This has caused further excitement in an extremely volatile and speculative asset class. Although most of our more tenured clients don’t likely have much interest in this space, we realize your children and/or grandchildren, and some of our younger clients may be interested in digital assets. Our sincere hope is that the info we provide in this missive will help them to make an informed decision before rushing blindly into crypto, or any other investment fad that will inevitably come our way. Here’s our take on today’s current crypto enthusiasm:

Bitcoin, like Gold, is a ‘non-productive’ asset. That simply means that these assets do not now – and will not ever – produce anything. Non-productive assets have no internal rate of return, they therefore lack any intrinsic value. Those who own non-productive assets believe (or hope) there will always be somebody who is willing to pay a higher price for that asset than what they paid for it… Without any fundamentals whatsoever driving those future price increases. This is known as the ‘greater fool theory,’ and it never ends well. Could it be different this time? Perhaps. But consider the following history, starting with the last gold frenzy that peaked in 2011:

From January 1, 2001 to August 2011, the price of gold bullion soared from $265 USD per ounce to over $1920 USD per ounce. Investors back then were allocating significant portions of their investable assets to gold. Ads for physical gold (and gold ETFs) were everywhere. Perma-bears and the usual prophets of doom were dominating the airwaves, claiming gold was the only rational choice for investors.

As usual, I looked to Warren Buffett for advice. He said productive assets would always beat non-productive assets in the long run. Take a look at this clip of Warren Buffett speaking to this, right around the time gold was peaking, after more than a decade of surging gold prices. You’ll also hear Buffett refer to Exxon in this clip. Remember when ExxonMobil was the most valuable company in the world? Peak oil theory was another thing going on at the time – but that’s a story for another day…

https://youtube.com/shorts/XKcBtHByEkg?si=V4hE3xY2ZbxnV3w-

Over the next 13 years, Gold went on to produce a return of just 2.74% per annum. Now, that wasn’t a very good hedge against inflation, was it? Let’s compare that to the return of US equities during those same 13 years. The S&P 500 went on to produce an impressive 11.28% return. Wait a minute! Let’s not forget all those dividends that were reinvested over those same 13 years. The total return with dividends reinvested was an even more impressive 13.34% per annum.

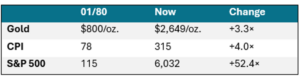

My theory is this: What Gold is to Baby Boomers, Bitcoin is to Millennials and Gen Z’s. While we don’t have a very long history for Crypto assets, we do have a very long history for Gold. See the chart below for Gold vs the US Stock Market over the past (almost) 45 years, pitting a non-productive asset class (Gold) versus a productive asset class (Equities):

*As you can see, over almost 45 years it’s not even close. U.S stocks have gone up 52.4 times vs Gold’s 3.3 fold increase. (Inflation has gone up 4 times)

*The price of the S&P 500 in this chart ignores 45 years of dividends, if only in an attempt to be fair to gold, which of course doesn’t pay dividends, interest, or anything else. (Neither does Bitcoin for that matter)

*Eight hundred dollars invested in the S&P 500 in January of 1980 and left to compound, would be worth around $129,079 today (Dividends reinvested) Compare this to Gold’s current price of $2,649 (As mentioned, gold produces no dividends to reinvest…)

Now back to the bitcoin mania… It is worth mentioning that some of the businesses you own in your portfolios with us, have indeed benefitted from the proliferation of bitcoin and all of the other 2.4 Million cryptocurrency tokens that have been “minted” to date. Companies like Nvidia and AMD are good examples. Before the Artificial Intelligence explosion, these chip manufacturing businesses were already making record profits as demand for their chips skyrocketed in part, due to all of the nonstop mining of all of those cryptocurrency tokens. (Crypto mining requires an ENORMOUS amount of computing power.) The share prices of these businesses were rewarded with absolutely explosive returns.

Productive businesses like the aforementioned, that sell actual products and services that consumers actually want and need, produce actual revenues and profits which every true investor actually wants and needs. We firmly believe that a properly diversified equity portfolio will produce superior returns over an investing lifetime. Far superior to the returns that any crypto tokens or precious metals are likely to produce.

None of this is new. There have been countless other speculative frenzies that have blown up spectacularly. Here are just a few of the big ones for you very briefly:

*The Tulip craze in 1630: Tulip prices were selling for ten thousand guilders at their peak. (This was roughly the price of a mansion on the Amsterdam Grand Canal!) The tulip bulbs went on to lose 99% of their value when that bubble inevitably burst.

*The South Sea Bubble of 1720: Sir Isaac Newton, arguably the smartest person in the world at the time, invested in the South Sea Company – nearly at its peak! After its collapse, Sir Isaac lost the bulk of his sizable fortune. Apparently, gravity applies to asset prices as well as to the motion of the planets… (see what I did there?)

*The 1980’s Japanese stock and real estate bubble: Perhaps one of the biggest financial bubbles ever. From 1956 to 1986 land prices in Japan increased by 5000%. The bubble ultimately burst and it took the Japanese market around three decades to recover.

*The 1990s dot com bubble: (I started my advisory career in the mid-nineties, so this was my first opportunity to witness a truly massive bubble firsthand!) The Nasdaq lost over 82% of its value when that bubble finally burst. It took a full 15 years for the tech-heavy Nasdaq index to recover from the losses.

*The US housing bubble, which grew for a decade and then collapsed in 2008, caused the financial crisis and the Great Recession. Bear Stearns and Lehman Brothers went to zero.

* 2022: The rise of meme stocks and NFTs (Non-Fungible Tokens). Those bubbles ultimately collapsed as interest rates skyrocketed and inflation hit 40-year highs. In November of 2022, FTX, a very popular Cryptocurrency exchange, also collapsed, and $32 Billion evaporated in a matter of days.

By now, you probably get the point I’ve been trying to make and why we proceed with extreme caution toward any asset class or trend that attracts so much enthusiasm.

Who knows what the ultimate outcome of all of this speculation will look like decades from now? We would never claim to know exactly what the future has in store for cryptocurrencies. What we do know is this – the appropriate amount of speculation, or gambling, our team of Financial Planners will engage in on behalf of our clients is precisely zero.

Thank you, as always, for your confidence in us and in our approach.

You got paid to do what!?

Stuart Hay, HNW Financial

You got paid to do what!?

Stuart Hay, HNW Financial

I’ve been thinking a lot about alignment lately, possibly due to an abnormally high number of injuries I’ve inflicted on myself recently… It’s a very important factor in so many areas of our lives, from our posture to our finances. Anyone over the age of 40 that does anything physical has probably realized how important it becomes to do it correctly to keep from getting hurt!

The same principle holds true in all things business and investing as well. How an employee’s compensation plan is set up is very important. It has a direct impact on what they choose to do during the day and how they decide to do it.

When I was in university I ran a painting business during the summers. At the peak, I employed 6 painters full-time and one part-time. They got paid per project. If they finished quickly and with no time-wasting touch-ups, they would receive more per hour than if they worked slowly. A well-done job that was completed early would mean they could move on to the next one faster and so on. This was good for everyone involved, including the customer. At that time the minimum wage was $6/hour. I paid my painters $8/hour but estimated generously and once they really started humming they typically earned in the $12 – 15/hour range. Double the minimum wage and more than most of their friends were getting paid. They loved it (or at least said they did ) and most came back the next year to work with me again.

It took me a while to get there though. When I first started out, due to all sorts of training and logistical issues, they were paid per hour vs per project. It was amazing how long certain tasks could take when there was no incentive to work quickly… It was equally stunning later to see just how fast they could go, with even better quality, when properly motivated!

A few weeks ago some of the EdgePoint Wealth Management team came to Calgary, visited our new office and took us out for dinner. While we were out, Syd Van Vierzen (a portfolio manager who’s been with them for 6 years) described the differences between his compensation package now compared with how he was paid previously as a portfolio manager at a very large publicly traded investment firm. There he received a big salary and a quarterly bonus… very typical of the industry and in-line with other public employers. He was paid extra to beat the benchmark each quarter – but if he didn’t he still had the large salary to see him through. Ideally, he wanted to outperform it to get a little extra money, but he absolutely didn’t want to lose to it… as that could mean losing his job. This pay structure motivated him, and the rest of the team, to think and act a certain way; short-term and to hug the index.

Now that he’s at EdgePoint he is paid very differently. He receives a relatively small salary and by far the bulk of his compensation comes in the form of an at-risk bonus. This bonus is not based on quarterly results. It’s not even based on annual or 3-year numbers. It’s based on the firm’s 5-year performance number and his part in obtaining those results. In addition, they are not compared to a benchmark but rather to their peer group. This gives them the freedom to look completely different than the index – if they see fit. The team is motivated to do the best they can over time, without short-term distractions, which is also exactly what we all want.

The EdgePoint partners have 98% of their investable assets in the same funds as all of us. Combined, they’ve invested $161M and it has grown to $363M. They are much more motivated financially to increase the value of these existing assets than to bring in new money.

At HNW, we work hard to be aligned with our clients at our level as well. We do not charge commissions to move money around and feel that practice is unethical. As Daniel Kahneman demonstrated in his book “Thinking Fast and Slow”, we’d all make better investors by making fewer decisions. More often than not, those who make a lot of changes end up losing money. To pay someone to do that for/to you – to directly give an “advisor” money to do something that by and large will hurt the end investor – is insane.

We charge a percentage of your assets as a fee. No commissions to invest or charges to move things around. When your money goes up we make more and when it goes down we make less. We want it to go up as much as you do. Dave, Brad, Scott and I also have all of our own money invested right alongside our clients.

In rowing the goal of the crew is to be in perfect sync with one another: oars aligned at the same angle, entering and exiting the water at the same time, the same force being exerted with each oar stroke…alignment is where the real power comes from.

SVB

Dave Nickle, HNW Financial

SVB

Dave Nickle, HNW Financial

We’ve received a few queries from clients regarding the recent collapse of SVB (Silicon Valley Bank), Signature Bank and Silvergate Bank. Although HNW Financial clients have no exposure to these banks we thought you’d nonetheless appreciate our perspective on this recent event, which has caused some unease for many investors, especially those with significant exposure to banks in general. Below is the response I sent to one of our very favorite clients this morning (I have only slightly edited it for client confidentiality – and suitability! 🙂

Please be assured you have absolutely no exposure at all to SVB, Signature or Silvergate, nor do you have any exposure to the gross & crooked underworld of cryptocurrencies for that matter. The most recent casualty, SVB was a major lender to venture capitalists and startups – many of which had little to no earnings. Because of all the turmoil in the startup world and the rise in interest rates globally, there was a run on this bank’s deposits, which required financial regulators to step in. I believe many investors still have PTSD from the 2008 financial crisis when Bear Stearns & Lehman Brothers collapsed. As a result, this recent event has caused some ripples in the financial markets especially for smaller regional banks.

Because you have a broadly and very beautifully diversified portfolio actively managed by some of the best global portfolio managers in the world you have absolutely nothing to worry about. We don’t just grow our client’s wealth, we also protect it very effectively, as you know…

It also doesn’t hurt that you have a team of the world’s greatest and best (and most modest) financial planners on God’s green earth quarterbacking your family’s financial plan. You will not only survive any and all of the turmoil that afflicts the masses – you will actually profit from said turmoil… just like you did from the tech bubble blowout in 2000, the terrorist attacks in 2001, the corporate malfeasance and accounting scandal in 2002, the financial crisis in 2008, the Eurozone crisis in 2010, the downgrade of US debt in 2011, the fiscal cliff in 2012, the collapse in oil prices in 2015, the Covid crisis in 2020, and yes, the current situation of 40 year high interest rates, the collapse of glamour & meme stocks, FTX and now SVB…. whew!

And despite all of the aforementioned carnage your portfolio has not just survived, it has prospered. As importantly, it will continue to grow AND beat the living daylights out of inflation, from now till the yawning grave comes for us all… which hopefully isn’t for three or four more decades so we can continue to compound the living daylights out of your investments with us…

So there you have it – I sincerely hope these words have inspired you as much as they did me!

Give me a shout if you need any more reassurance, we’re all here for you anything you need. -Dave-

We would also like to add one more point here. Banks – in general – are very strong, and they are very well capitalized. As a group, they are in a much better state than they were during the 2008 financial crisis. They definitely are NOT in the same position as SVB, and other banks that were highly exposed to a fast-growing but cash-hungry group of clientele – dominated by fast-growing but often profitless companies – and you may have guessed it – this would include some of those sleazy cryptocurrency startups…please don’t get us started!

Brad, Stu & I invite any of you, to call any of us, if you would also appreciate some reassurance, if you have any questions, and also if you’d like to add more money to any of your portfolios with us to take advantage of this “crisis du jour” Alas, these sales are always only just temporary!

We’re all here for & we promise if you do reach out, we will brag about our firm just as modestly as we possibly can. Admittedly, my esteemed colleagues are a wee bit better at that than yours truly. But I’m working on it! 😉

Can you feel that?

Stuart Hay, HNW Financial

Can you feel that?

Stuart Hay, HNW Financial

I am constantly amazed by the ways that our brains work. It fascinates me because, even though people are wildly different from one another, as a population we tend to think the same ways about certain things. We may come to different decisions in the end but we often go through a lot of the same thought processes and feelings on our way there.

For most people, the strongest lessons come more from the most emotional events we experience. If you make a big mistake (and can figure out where you went wrong) you’ll probably change your behaviour to try to never feel that way again. On the other hand, if you do something really enjoyable, you’ll likely try to repeat that positive feeling.

If the mistake is too small, the lesson may be too subtle to really learn from… especially for us men. 😉 Many times we need to be hit over the head with a concept before we fully understand it. We need to feel it.

From a financial perspective, the amount of money involved adds to the emotion behind the decisions and the power of the lessons that result. To illustrate:

• When a $50,000 portfolio moves 20% the fluctuation is $10,000

• When a $500,000 portfolio moves 20% it is $100,000

• When a $5,000,000 portfolio moves 20% it is $1,000,000

The lower amounts are certainly not meaningless but they are also not life-changing for most people and therefore the lessons are small. They don’t move the needle. When your portfolio changes by the amount you earned last year or more, either up or down, it sets the stage for real lessons. Lessons that get remembered forever. A drop by that much can be terrifying – especially if it is unexpected. When things inevitably rise later on by that much and more it feels fantastic. The outsized increase also brings with it a level of belief and understanding that smaller amounts simply can’t generate.

I found these lessons started happening for me once I really committed to this plan. As many of you know, my first role out of university was as an advisor at Investor’s Group. I got immersed in the investment world right out of the gates and learned the edge owning businesses has over bonds early on. Similar to some religions, I went out at a young age (at times even door to door) trying to convert the world to this way of thinking and what really happened was that I got converted myself.

I left Investor’s Group in 1996 and eventually moved into the recruiting world where I helped people find new jobs and companies find strong new employees. I was no longer thinking about investing in businesses all the time and became distracted by other places to put my money. In the early 2000’s I was seduced by real estate. When the oil and gas boom took our Calgary home with it, I got sucked in.

I watched our $132,500 home (an incredibly meaningful amount of money to me at the time) rise to $450,000 a few years later. I enjoyed that feeling a lot and tried in vain to duplicate it. Finally, by 2009 I realized that the confluence of events that caused this anomaly was unlikely to happen again… certainly not with the regularity required to make a successful long-term investment policy out of it.

Fortunately, throughout these years I continued to invest in RRSPs and then a family RESP. I was putting any extra funds into real estate but thankfully I didn’t stop my equity investing program. Eventually, almost in spite of myself, I developed the meaningful amount of money necessary to generate the good lessons that came out of 2012 and 2013 when the market finally began to rip.

My belief returned with a vengeance and I really started to lean into investing this way. That’s when things genuinely started to move for me personally. As our account grew, my belief grew. As my belief grew I funnelled even more money into these investments (instead of into real estate) and our account grew even faster – even though it was a lumpy ride.

On a side note, it was about this time I figured out that it doesn’t matter if our account goes up because we saved new money or it goes up because the market increases the value of the investments we already own. Saving money is hard. Keeping some of the money you earn is a success. Buying shrewd investments that go up is also a win. The end result is the same and, more importantly, the feeling is the same.

Finally, in 2016, the opportunity to personally return to this industry as a profession came when Dave moved out to the island. I understand completely how life-changing investing this way has been for me and my family. Now I do my best to help as many people as possible come to the same realization and eventually the same success.

The key is to go all in… like this:

Please note: BASE jumping is an exaggeration that only crazy people do! The concept is what’s important; 100% commitment is the place where real success comes from.

You have to own enough of something to feel it.

We at HNW certainly do. We all own the same investments as our clients and the growth in our assets under management has been astounding. We have gone from $95M at the bottom of the COVID crisis to very close to $200M today. Those of you that have been with us for that whole period, especially the ones with larger accounts, have certainly felt it.

How to Approach a Bear

Dave Nickle, HNW Financial

How to Approach a Bear

Dave Nickle, HNW Financial

We’d like to share some facts about Bear markets with you. The first fact you need to know about bear markets is that they are as common as dirt! There have been 27 bear markets (using the S&P 500 as our guide) since 1928. Since World War II, there have been 15 of them, which works out to one about every 5 years.

Since bear markets are as common as dirt, and because they are simply inevitable and unavoidable, it is absolutely crucial to approach them properly. Especially when you consider these facts:

• Half of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market.

• Another 34% of the market’s best days took place in the first two months of a bull market—before it was clear a bull market had begun!

So knowing this, it should be crystal clear to any serious investor that any attempt to time the market – in ANY sense – is a very effective way to blow one’s financial brains out. Which is what the vast majority of stock market participants always do….. ALWAYS!

Now, please consider the good news below, which will give you the Faith, Patience & Discipline every true investor must possess to achieve their financial goals:

Bear markets tend to be very short-lived. The average length of a bear market is about 9.6 months. That’s significantly shorter than the average length of a bull market, which is 2.7 years. Of the last 92 years of market history, bear markets have comprised only about 20.6 of those years. Put another way, stocks have been on the rise 78% of the time.

Bear markets should be endured at the very least, however we recommend our clients to EMBRACE them.

For investors who are actively saving for retirement, bear markets are a gift from heaven! But alas, these sales are only temporary… So if you have the means, back up the truck and load up as much as you possibly can while grown men are weeping – embrace the opportunity while it lasts.

For retired clients, bear markets, understandably, don’t feel like such a gift, but consider this: reinvested dividends & capital gain distributions (which can be very substantial) can be reinvested at bargain prices, ready for the inevitable return of the bull market.

It should also be noted that any investor at any stage in life can control their own behavior. Most big purchases can be deferred. So during adverse market conditions we suggest kicking the can down the road on big ticket items. Wait it out, and only use what funds are absolutely necessary during inclement market conditions. When the bear market inevitably ends, you can then celebrate by unclenching those purse strings when conditions are more favorable…

At HNW Financial, we are long-term, goal-focused, plan-driven equity investors. We and our clients own diversified portfolios of superior companies which have demonstrated the ability to increase earnings (and in most cases dividends) over time, supporting increases in their value.

Change your relationship to volatility and you’ll put the odds firmly in your favour of investment success. We may be wrong, but we doubt it!

Source for bear/bull market stats is Ned Davis Research as of 12/15/21.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.